|

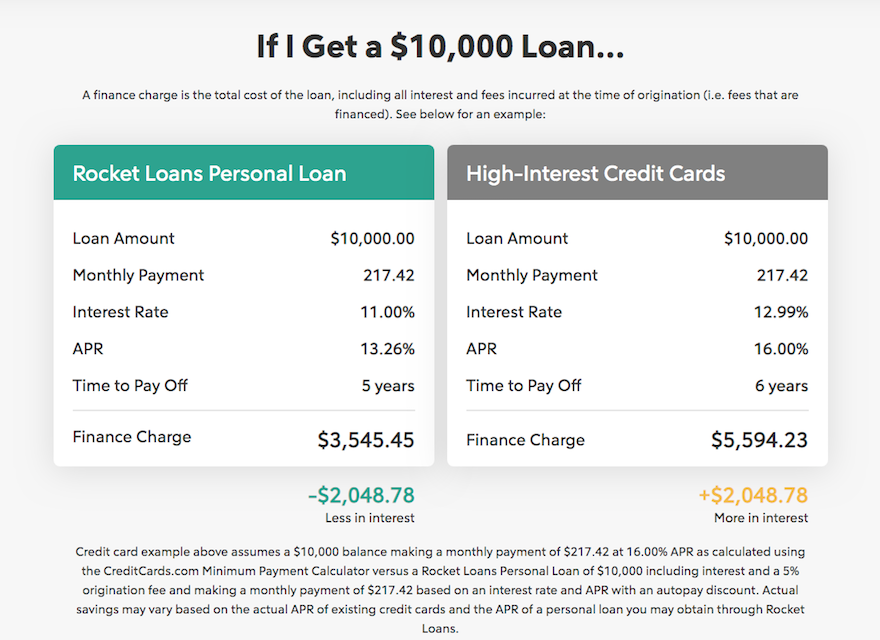

Last week we shared important details about the advantages of using a Home Equity Line of Credit (HELOC) to help finance your home remodeling project. As we explained originally in this "How To Pay for Your Brand New Bathroom" article from March 2019, HELOCs are a common financing option for home owners with positive home equity. Another popular option we've identified is unsecured financing, also known as a signature loan, and that brings us to today's exciting news to share for our future clients! Our entire team at Diamond Bath is proud to announce a new partnership with a nationally recognized leader in personal finance, Rocket Loans! You may have seen their advertisements on TV, or within your favorite publications, and you may even have their app on your smartphone, but we are excited at how easy this new partner makes it for our clients to secure the funding needed for professional home remodeling projects. If you've just purchased your home within the past year or two, you may not have positive equity yet for a HELOC, and tapping high interest rate credit cards may not make sound financial sense. For those with good credit scores, a Rocket Loan, paid over the course of five years could actually save you money versus your credit card. Here's a helpful comparison, right from their website, for a $10,000 loan: Beyond the very competitive financing rates and low fees, Rocket Loans is also convenient! Diamond Bath uses a project management system called Buildertrend to create our bathroom remodeling proposals, track the progress of each job and help keep our clients informed about the status of their project. Because Buildertrend and Rocket Loans are integrated, all Diamond Bath clients can apply for a signature loan with just a few clicks. This new partnership between Diamond Bath and Rocket Loans gives our local customers another affordable option to consider to help turn their "dream" bathroom into a beautiful reality!

|

DiamondBathFeaturing the best of bath remodeling tips Archives

May 2022

|

RSS Feed

RSS Feed